On Friday 23rd September 2022, Chancellor Kwasi Kwarteng announced permanent stamp duty cuts for some home-buyers in the Government’s ‘mini-budget’.

Stamp duty is a tax payable to the Government when you buy a home, or land, priced above a certain threshold in England or Northern Ireland.

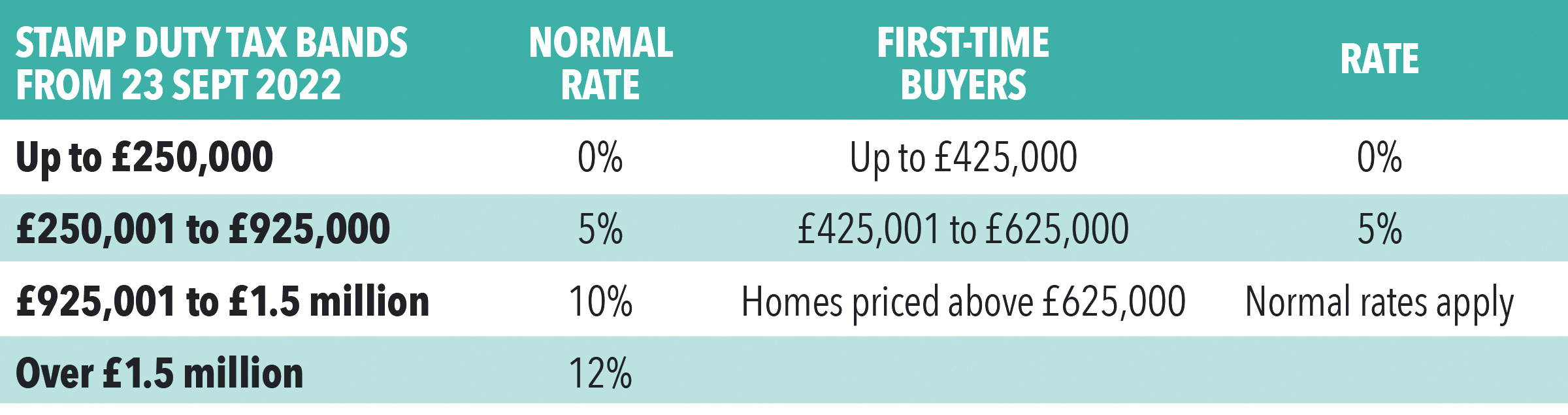

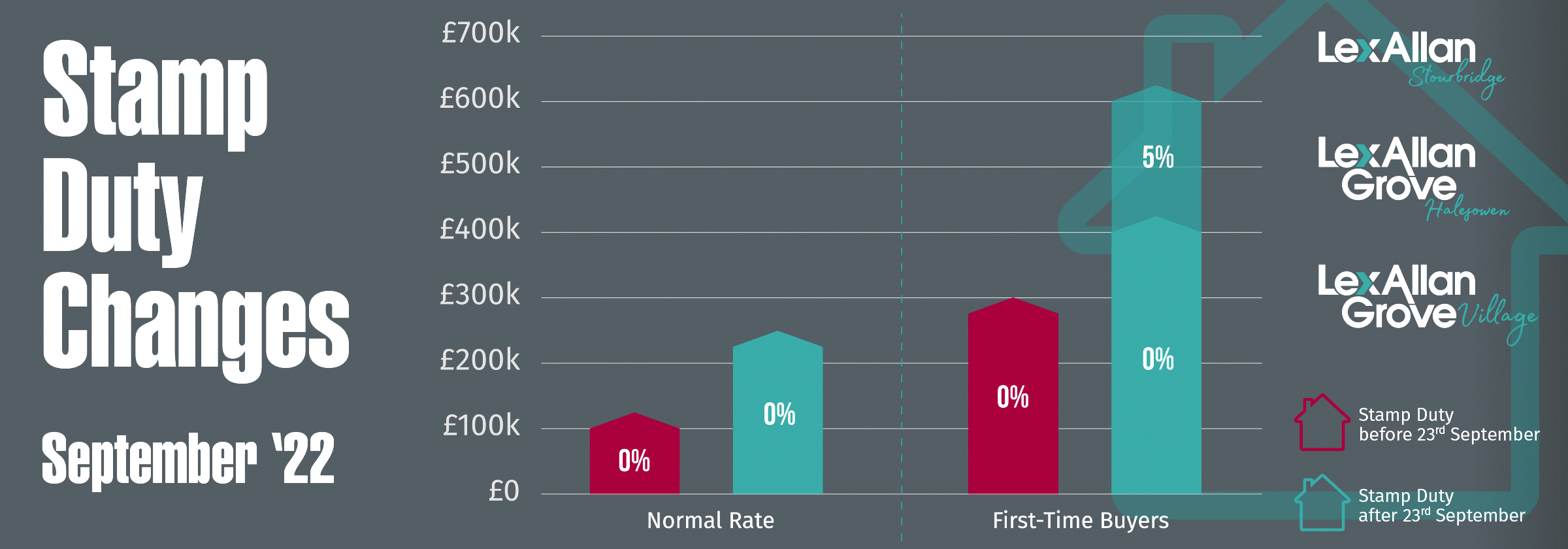

Previously, you would pay Stamp Duty Tax on a home, or the portion of a home, priced between £125,001 and £250,000. Following today’s announcement, no stamp duty is payable below the price threshold of £250,000.

This means a third of all homes currently for sale (33%) are now completely exempt from stamp duty in England, compared to 7% when the threshold was £125,000.

Before today, first-time buyers paid no stamp duty on the first £300,000 of a home purchase. This has now been raised to £425,000. And if the home you’re buying is priced below £625,000, you’ll still pay no stamp duty on the portion of the property priced below £425,000, and 5% on the portion priced above this. This is an increase of £125,000 on the previous price cap of £500,000.

These changes will reduce stamp duty bills across the board for all home-movers by up to £2,500, with first-time buyers able to save up to £11,250.

The cuts also mean that two thirds of homes (66%) are now exempt from stamp duty for first-time buyers in England.

What are the stamp duty rates now?

Please do not hesitate to contact us on 01384 442464 for Stourbridge, 0121 550 5400 for Halesowen or 01562 270270 for Hagley

2 minute read posted by

2 minute read posted by

by

by

by

by

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link